Net Working Capital Of Sales . working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. Stating the working capital as an absolute figure makes little. Here is what the basic. what is net working capital? Simply put, net working capital (nwc) is the difference between a company’s current assets and. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. working capital to sales ratio = working capital / sales. Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. the net working capital formula is calculated by subtracting the current liabilities from the current assets.

from quickbooks.intuit.com

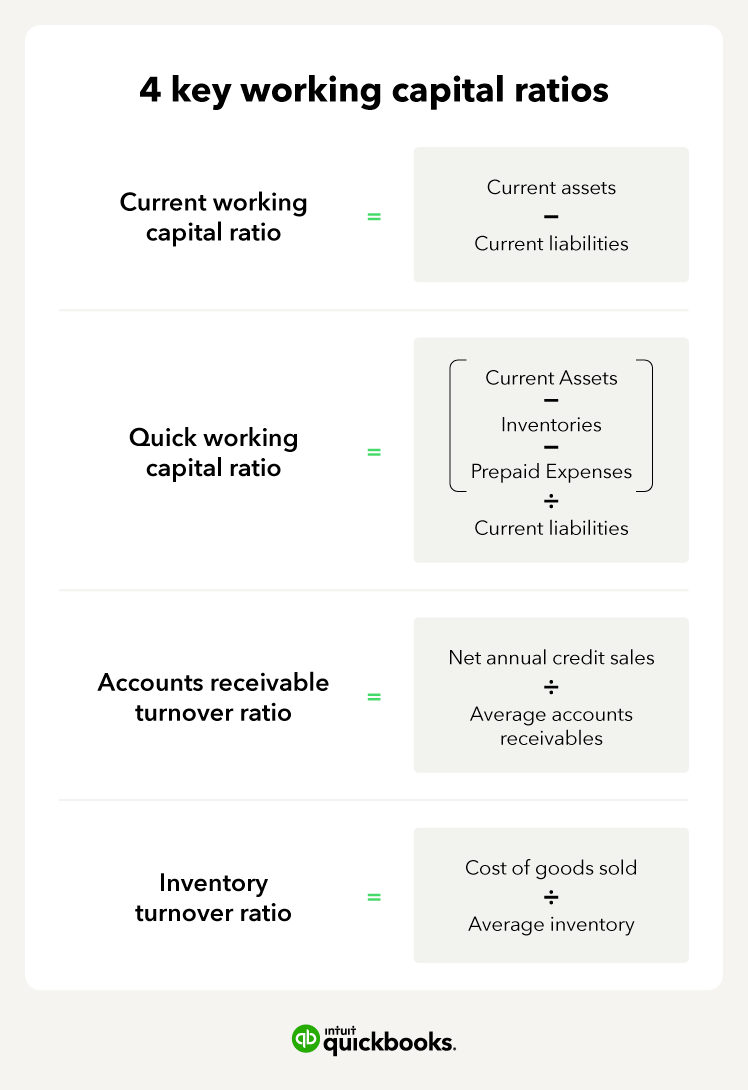

working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. Here is what the basic. net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. Stating the working capital as an absolute figure makes little. the net working capital formula is calculated by subtracting the current liabilities from the current assets. what is net working capital? the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. working capital to sales ratio = working capital / sales. Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. Simply put, net working capital (nwc) is the difference between a company’s current assets and.

Working Capital Definition & Formula for 2024

Net Working Capital Of Sales working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. what is net working capital? Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Here is what the basic. working capital to sales ratio = working capital / sales. the net working capital formula is calculated by subtracting the current liabilities from the current assets. Stating the working capital as an absolute figure makes little. Simply put, net working capital (nwc) is the difference between a company’s current assets and.

From wikifinancepedia.com

Net Working Capital Meaning, Examples, Formula, Importance, Change Impact Net Working Capital Of Sales working capital to sales ratio = working capital / sales. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. the net working capital formula is calculated by subtracting the current liabilities from the current assets. Simply put, net working capital (nwc) is the difference between a company’s. Net Working Capital Of Sales.

From www.slideserve.com

PPT Working Capital PowerPoint Presentation, free download ID1656448 Net Working Capital Of Sales net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. working capital to sales ratio = working capital / sales. Here is what the basic. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. working capital, also called net working capital (nwc), is the. Net Working Capital Of Sales.

From www.fool.com

A Small Business Guide to Calculating Net Working Capital The Blueprint Net Working Capital Of Sales the net working capital formula is calculated by subtracting the current liabilities from the current assets. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Simply put, net working capital (nwc) is the difference between a company’s current assets and. Stating the working capital as an absolute figure makes little.. Net Working Capital Of Sales.

From endel.afphila.com

Net Working Capital Guide, Examples, and Impact on Cash Flow Net Working Capital Of Sales the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. what is net working capital? Here is what the basic. Stating the working capital as an absolute figure makes little. Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. net. Net Working Capital Of Sales.

From www.pcecompanies.com

How Net Working Capital Impacts the Value of Your Business Net Working Capital Of Sales working capital to sales ratio = working capital / sales. what is net working capital? the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. Simply put, net working capital (nwc). Net Working Capital Of Sales.

From www.superfastcpa.com

What is the Net Working Capital Ratio? Net Working Capital Of Sales Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. Here is what the basic. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. the sales to working capital ratio is calculated by dividing annualized net sales by average. Net Working Capital Of Sales.

From blog.credlix.com

Understanding Net Working Capital Net Working Capital Of Sales net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. the net working capital formula is calculated by subtracting the current liabilities from the current assets. Here is what the basic. working capital to sales ratio = working capital / sales. working capital, also called net working capital (nwc), is the difference. Net Working Capital Of Sales.

From quickbooks.intuit.com

Working Capital Definition & Formula for 2024 Net Working Capital Of Sales Simply put, net working capital (nwc) is the difference between a company’s current assets and. the net working capital formula is calculated by subtracting the current liabilities from the current assets. working capital to sales ratio = working capital / sales. working capital, also called net working capital (nwc), is the difference between a company’s current assets. Net Working Capital Of Sales.

From www.educba.com

Net Working Capital Formula Definition, Formula, How to Calculate? Net Working Capital Of Sales Simply put, net working capital (nwc) is the difference between a company’s current assets and. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. what is net working capital? net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. working capital to sales ratio. Net Working Capital Of Sales.

From www.g2.com

What Is Net Working Capital? Importance and Limitations Net Working Capital Of Sales the net working capital formula is calculated by subtracting the current liabilities from the current assets. working capital to sales ratio = working capital / sales. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. net working capital (nwc) compares a company’s operating current assets (excluding. Net Working Capital Of Sales.

From www.slideteam.net

Working Capital Net Working Capital Global Sales Integration Cpb Net Working Capital Of Sales Stating the working capital as an absolute figure makes little. working capital to sales ratio = working capital / sales. what is net working capital? Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. working capital, also called net working capital (nwc), is the difference between a. Net Working Capital Of Sales.

From www.stfuandplay.com

A complete guide to net working capital and how to calculate it Net Working Capital Of Sales the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. the net working capital formula is calculated by subtracting the current liabilities from the current assets. Working capital as a percentage of sales tells a business how much of every sales dollar must go toward. Simply put, net working capital (nwc). Net Working Capital Of Sales.

From www.wallstreetmojo.com

Net Working Capital (Definition, Formula) How to Calculate? Net Working Capital Of Sales the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Here is what the basic. what is net working capital? Stating the working capital as an absolute figure makes little. Simply put, net working capital (nwc) is the difference between a company’s current assets and. working capital to sales ratio. Net Working Capital Of Sales.

From www.divestopia.com

Normal level of net working capital at Closing Divestopia Net Working Capital Of Sales Here is what the basic. Simply put, net working capital (nwc) is the difference between a company’s current assets and. working capital to sales ratio = working capital / sales. what is net working capital? Stating the working capital as an absolute figure makes little. net working capital (nwc) compares a company’s operating current assets (excluding cash. Net Working Capital Of Sales.

From corporatefinanceinstitute.com

Net Working Capital Guide, Examples, and Impact on Cash Flow Net Working Capital Of Sales working capital to sales ratio = working capital / sales. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. net working capital (nwc) compares a company’s operating current assets (excluding cash and cash. Here is what the basic. what is net working capital? the sales. Net Working Capital Of Sales.

From www.ccbfinancial.com

Publications Understanding Net Working Capital in M&A CC Capital Net Working Capital Of Sales the net working capital formula is calculated by subtracting the current liabilities from the current assets. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Stating the working capital as. Net Working Capital Of Sales.

From www.netsuite.com

What is Working Capital? How to Calculate and Why It’s Important NetSuite Net Working Capital Of Sales what is net working capital? working capital to sales ratio = working capital / sales. Here is what the basic. the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities.. Net Working Capital Of Sales.

From calculator.academy

Sales To Net Working Capital Ratio Calculator Calculator Academy Net Working Capital Of Sales the sales to working capital ratio is calculated by dividing annualized net sales by average working capital. working capital, also called net working capital (nwc), is the difference between a company’s current assets and current liabilities. Simply put, net working capital (nwc) is the difference between a company’s current assets and. net working capital (nwc) compares a. Net Working Capital Of Sales.